Cryptocurrency is probably the hottest asset for investment in the modern markets right now. The value of cryptocurrencies soaring up to tens of thousands of dollars for each unit is a great reason for investing in cryptocurrency and trade with it. However, there are many significant concerns you must take care of before investing in crypto.

The pointers for buying cryptocurrency for the first time can serve as significant support for anyone trying their hand at crypto investments for the first time. However, the different news pieces regarding uncertainty in the value of cryptocurrencies alongside the newly emerging regulations pertaining to cryptocurrencies have been creating doubts about cryptocurrencies.

Is it reasonable to invest in cryptocurrencies? Well, the top benefits of investing in cryptocurrency can show you some valid reasons for adopting them. However, you must be careful when you are investing in crypto for the first time. The following discussion offers you a detailed guide on the top factors you must verify before buying cryptocurrency.

Why Should You Buy Cryptocurrency?

Money has been changing forms for many years, and you can notice that cryptocurrencies are an interesting take on digital money. You have the advantage of blockchain technology with cryptocurrencies in the form of decentralization, encryption, immutability, and transparency.

A first-time cryptocurrency buyer would obviously look for the estimates of value they can get from their investments in cryptocurrencies. For starters, you have the benefit of ownership over a new and unique digital asset that might gain immense value in the future. On top of it, many cryptocurrency coins and tokens are designed with specific utilities in mind.

Important Points to Know before Buying Cryptocurrency

Investments in cryptocurrency are more of a trendy thing in the present times. Almost everyone wants a piece of the seemingly tasty cake of cryptocurrencies. However, it is difficult for a first-time crypto buyer to navigate the technicalities of crypto investments. Therefore, you would need a solid guide on the best practices you must follow before you invest in cryptocurrency.

1. Learn about Investing in Crypto

The first thing you need to know about how to buy cryptocurrency is the overview of mechanisms for purchasing, exchanging, and selling cryptocurrencies. Without an idea of how you should approach crypto investments, you cannot blindly invest your money in cryptocurrencies.

Look for the platforms which help you in depositing and withdrawing fiat currency within a crypto ecosystem. You can explore all the basic steps in the crypto platform, such as the simple purchase and sales options. When you are confident about the processes for buying, selling, and trading cryptocurrencies, you are more likely to make some productive choices.

2. Go For a Balanced Portfolio

The second important pointer in a beginner’s guide to buy cryptocurrency would obviously focus on creating a diversified and balanced portfolio. You cannot just put all your money on a single crypto coin in the hope that its value will rise. Keep in mind that cryptocurrencies are a highly risky asset in comparison to other investments, particularly due to volatility.

The pricing of crypto coins has been fluctuating with massive variations in comparatively shorter periods of time. In addition, the important tips for buying cryptocurrency also draw attention to the lack of specific regulations for cryptocurrencies. You don’t have the legal backing of an insurance company to recover your losses in cryptocurrencies.

On the contrary, you can avoid the tribal instinct for getting on board with a popular crypto coin or token. There are many scammers out there as well as staunch evangelists who would go to any height to make you believe in the particular cryptocurrency. As a first-time cryptocurrency buyer, you may develop the urge to invest in a cryptocurrency that seemingly promises a hefty return. However, you don’t have to go through such risks as a first-time investor. On the contrary, you can try spreading your portfolio across various projects in different sectors such as DeFi, gaming, NFTs, and others.

3. Research is Mandatory

The most prominent addition in any guide on investing in cryptocurrency would obviously point to the limelight on research. Any type of investment requires a good amount of research before you invest the same in an asset. Hours of an endless investigation into the origins of cryptocurrency and its utility can help you understand the value you can get from it.

At the same time, research also helps you take note of the risks associated with specific cryptocurrencies of your choice. Make sure that you don’t fall for the idea of ‘someone will buy it at a higher price in the future’ while considering investments in a cryptocurrency.

One of the mandatory additions in tips for buying cryptocurrency, the importance of research is evident in the broad range of information you can access about the cryptocurrency. Look for community forums, online communities as well as crypto developer mailing lists alongside podcasts of crypto professionals. Build your expertise in cryptocurrencies and the related aspects such as economics and cryptography. Clear all your doubts about cryptocurrencies and learn comprehensively about them to judge cryptocurrencies better when it comes to investing.

4. Don’t Join the Herd

One of the common mistakes of a first-time crypto buyer points to the feeling of missing out on a trend. Many crypto beginners make the mistake of giving in to their ‘fear of missing out’ only to lose everything. Your instincts can play foul without the support of adequate research, thereby leading to an upset with your investments. If you feel something about a specific cryptocurrency, then the best course of action would be to evaluate the option cautiously. Many failing cryptocurrencies report valuations rising by almost 30% in 24-hour periods for duping unaware beginners.

So, how to buy cryptocurrency when there are so many hidden complications? The answer points to understanding the complications before they present any problems. Research can help you stay away from any random decisions based on public opinion. You must evaluate the merits and demerits of the cryptocurrency before putting in your hard-earned money.

5. Some Stories are Too Good

Keep in mind that cryptocurrencies rise in value not only on the basis of their utility but also on their perceived utility. The crypto world has many charlatans who would take the first opportunity to weave far-fetched stories about their projects. For example, you must have found many projects which offer the promises of surpassing Bitcoin. Therefore, if a cryptocurrency promises unrealistic benefits, then you must check into it.

A first-time cryptocurrency buyer must take note of specific factors such as underlying mechanisms with crypto platforms. For example, some crypto exchanges can fool you with the opportunity to draw around 99% of your investment as loans while juicing the profits in event of a rise in the value of the coin. On the other hand, you can lose the complete investment if the value of the coin reduces in value.

6. Trustless Approach

The crypto market has become a fertile ground for scammers, despite the promises of cryptographic security. For example, some scammers used Elon Musk’s SNL appearance as a tool for cheating people of $100,000 worth of crypto assets. How did the scammers achieve this? They just put out a ‘false’ giveaway and showed another important threat to look out for when you buy cryptocurrency or tokens.

The scammers used a fake Twitter account of Saturday Night Live and asked victims to send small amounts of crypto for address verification. In return, the scammers promised around 10 times the amount return. Quite an attractive and hard-to-ignore value proposition, isn’t it? Therefore, you should try to follow a trustless approach while navigating the crypto domain. Always rely on research and verification as your first course of action when you think of investing in cryptocurrency, as it can help you avoid scams.

7. Avoid the Unit Bias

Unit Bias is basically the assumption that a cryptocurrency trading at $50,000 per unit is better than a coin trading at $1. However, you must shed such assumptions when you think of buying cryptocurrency. With around thousands of cryptocurrencies all over the world, you are likely to explore a broad range of functionalities.

The tips for buying cryptocurrency would obviously draw attention towards removing ‘Unit Bias’ as different cryptocurrencies come with varying functionalities. For example, some might have better decentralization, while some can offer improved developer support. Therefore, a deep dive into the technological mechanisms underlying a specific cryptocurrency can speak a lot about its potential.

8. Get the Right Wallet

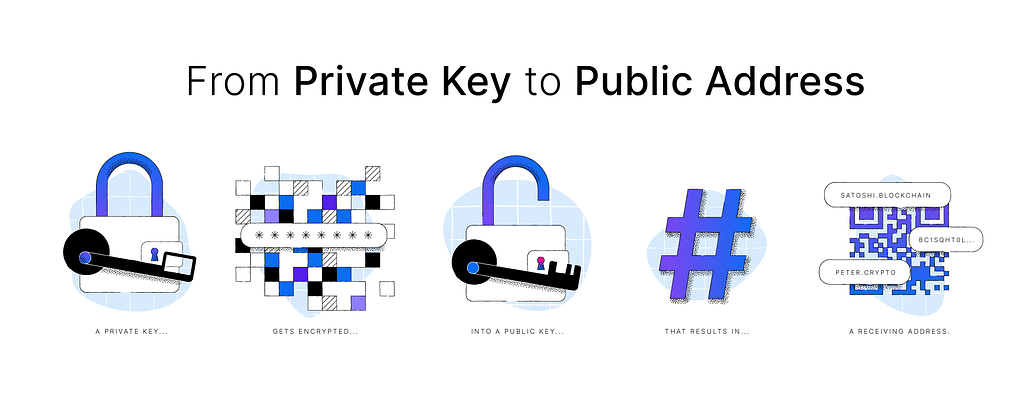

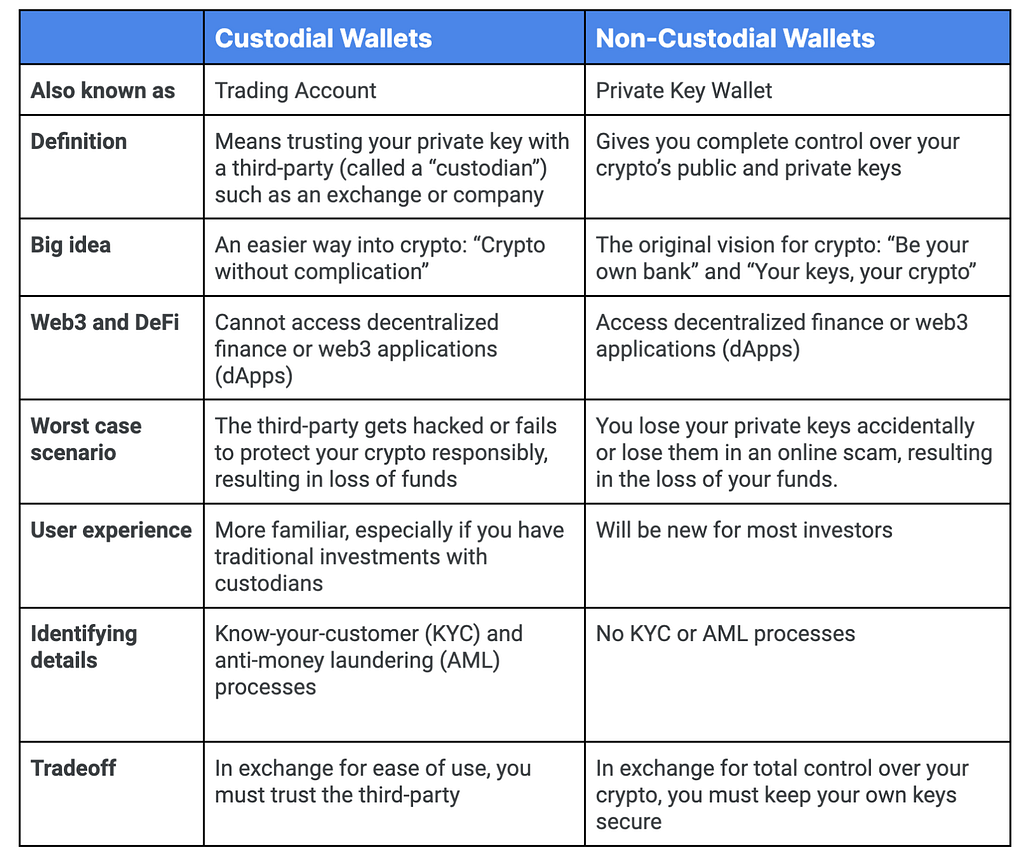

You must also pay attention to the choice of a suitable crypto wallet for your cryptocurrencies. Cryptocurrencies are basically assets where the holder is considered the rightful owner. So, the concerns regarding how to buy cryptocurrency must also focus on choosing a wallet that can hold the cryptocurrencies safely. However, crypto wallets work by storing private keys to the cryptocurrencies on a blockchain.

Which type of wallet should you choose as a beginner? The common answer would point at the crypto exchange, which would serve as a cryptocurrency wallet. On the other hand, DeFi solutions have encountered some of the biggest hacks in the course of the last year. Therefore, you should pay adequate attention to choosing a crypto wallet that can safeguard your assets with ease.

9. Fractional Ownership is a Thing Now

Another prominent pointer for any first-time cryptocurrency investor would point at the possibilities for fractional ownership of cryptocurrencies. For example, you don’t have to worry about purchasing one complete Bitcoin to establish your crypto ownership. Now, fractional ownership of cryptocurrencies lets you purchase crypto. One of the best examples is that of the small amounts of Dogecoin. As a result, you don’t have to go all-in for specific cryptocurrency investments.

10. Taxation and Regulatory Concerns

The final highlight in tips for buying cryptocurrency would focus on concerns regarding taxation and regulations. Taxation and regulatory concerns are important, especially in the US, for specific reasons. Similarly, the legal perspectives on cryptocurrencies in different jurisdictions can also play a crucial role in determining the expected returns from crypto investments.

Therefore, you need a clear overview of tax conditions alongside the regulations for crypto in your country or state before investing. Make sure that you don’t violate any law while ensuring proper optimization of your returns on the crypto investment.